Halal Home Protection: What Muslim Homeowners Should Look for in a Takaful Plan

For many Muslims in the U.S., buying a home is more than a financial milestone. It’s a place where families grow, guests are welcomed, and faith is lived day to day. Naturally, you want to protect that blessing—yet conventional homeowners insurance can raise serious Shariah concerns: interest (riba), uncertainty (gharar), and even investments in haram industries.

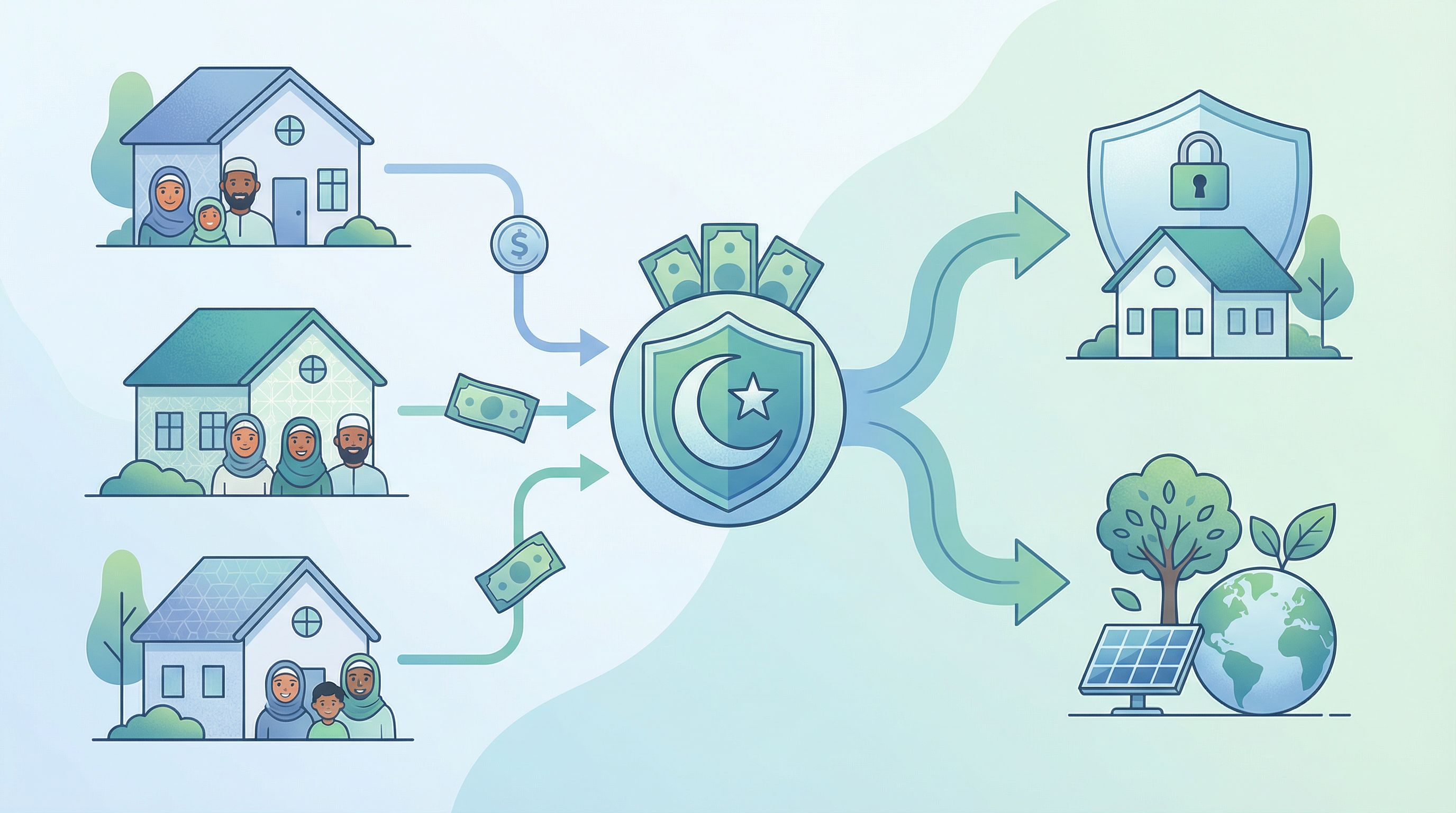

That’s where Takaful—Shariah-compliant risk sharing—comes in. A well-designed Takaful home protection plan allows you to safeguard your house, your family, and your long-term finances while staying true to Islamic principles.

This guide walks you through what to look for in a halal home protection plan, how Takaful differs from conventional insurance, and practical questions to ask before you sign up.

Why Halal Home Protection Matters

For Muslim homeowners, home protection is not just about replacing a roof after a storm. It’s about:

- Protecting a major amanah (trust): Your home is often your largest asset and a trust from Allah that must be preserved responsibly.

- Avoiding riba and haram investments: Many conventional insurers invest premiums in interest-bearing instruments or companies involved in alcohol, gambling, or other prohibited activities.

- Supporting mutual help (ta’awun): Takaful is built on the Qur’anic principle of cooperation and shared responsibility, not profit from others’ misfortune.

- Planning for the unexpected: Fires, theft, natural disasters, and liability risks can wipe out years of savings if you face them alone.

A halal home protection plan allows you to:

- Sleep at night knowing your family has a safety net.

- Build wealth in a way aligned with your values.

- Contribute to a community pool that helps other Muslims in difficulty.

Takaful America is one example of a U.S.-based provider built specifically to offer this kind of Shariah-compliant protection for homes, businesses, and families.

How Takaful Differs from Conventional Home Insurance

Before choosing a plan, it helps to understand the core differences.

1. The Nature of the Contract

- Conventional insurance is typically a sale of risk: you pay a premium, and the insurer takes on the risk in return for profit. This structure can involve excessive uncertainty and elements of gambling.

- Takaful is based on donation and mutual guarantee (tabarru’). Participants contribute to a shared pool, agreeing that:

- Contributions are partly a donation to help others.

- Claims are paid from this pool.

- The operator manages the pool for a fee or a share of any surplus, under Shariah rules.

2. Investment of Funds

- Conventional insurers may invest in interest-bearing bonds, conventional banks, or companies involved in haram activities.

- Takaful operators must invest the pool in Shariah-compliant assets only—no riba, no alcohol, no gambling, no adult entertainment, and no conventional interest-based finance.

3. Surplus and Profit

- In conventional insurance, any profit or surplus belongs to the insurer’s shareholders.

- In Takaful, any surplus (after claims and expenses) is typically shared with participants or retained in the pool for their benefit, according to the agreed model.

When you evaluate a home Takaful plan, you’re really asking: Is this structure truly different from conventional insurance, or just a label change?

Core Shariah Principles Your Home Takaful Plan Should Follow

When reviewing a plan, look for these foundational elements:

1. Clear Avoidance of Riba (Interest)

A halal plan should:

- Explicitly avoid interest-bearing investments.

- Avoid depositing large cash balances in conventional interest-bearing accounts.

- Not charge or pay interest on late payments or refunds.

Ask the provider:

- “How do you ensure that contributions and reserves are not invested in interest-bearing instruments?”

- “What is your policy on late payments—do you charge interest?”

2. Limited and Transparent Gharar (Uncertainty)

All contracts have some uncertainty, but in Shariah it must be minimized and made reasonable.

Look for:

- Clear policy wording: what is covered, what is excluded, and how claims are assessed.

- Transparent explanations of deductibles, coverage limits, and waiting periods.

If you’re not sure what something means in the policy, that’s a red flag. A Shariah-conscious provider should welcome your questions and explain in plain language.

3. No Maysir (Gambling)

Takaful avoids a gambling-like structure by:

- Framing contributions as donations to a mutual pool, not bets on an uncertain event.

- Sharing risk across many participants.

- Ensuring the operator is paid fairly for management, not for “winning” when you don’t claim.

4. Ethical and Halal Investing

A genuine Takaful plan will:

- Follow Shariah screening standards for investments.

- Avoid sectors like:

- Conventional financial services based on interest

- Alcohol, pork products

- Gambling and casinos

- Tobacco

- Adult entertainment

Ask for:

- A summary of their investment policy.

- Confirmation that their investments are screened by a qualified Shariah board.

Takaful America emphasizes ethical investing as part of its halal protection offerings, reflecting these principles in its product design.

What Your Halal Home Protection Should Actually Cover

Once you’re comfortable with the Shariah structure, you need to ensure the plan actually protects your home in real life.

Here are key coverage areas to look for in a home Takaful plan:

1. The Building Itself (Dwelling Coverage)

This covers the physical structure of your home—walls, roof, built-in fixtures—against specific risks.

Common covered perils include:

- Fire and smoke

- Storms, wind, hail

- Explosions

- Vandalism and theft

- Certain types of water damage (like burst pipes)

Check:

- Coverage limit: Is it enough to rebuild your home at current construction costs, not just what you paid years ago?

- Exclusions: Are floods, earthquakes, or hurricanes excluded or require separate coverage where you live?

2. Personal Belongings (Contents Coverage)

This protects furniture, electronics, clothing, and other personal items.

Ask about:

- Coverage limits for high-value items (jewelry, art, expensive electronics).

- Whether coverage is based on actual cash value (depreciated) or replacement cost (what it costs to buy new today).

3. Additional Living Expenses (If You’re Displaced)

If a covered event makes your home uninhabitable, this coverage helps with:

- Temporary rental housing

- Meals

- Other reasonable extra living costs

Confirm:

- How long this coverage lasts (e.g., 12 months, 24 months).

- Maximum dollar limits.

4. Liability Protection

Even in a halal framework, liability coverage is important. It protects you if someone is injured on your property or if you accidentally damage someone else’s property.

Ask:

- What are the liability limits?

- Are legal defense costs covered?

5. Special Risks Where You Live

Depending on your state or neighborhood, you may need:

- Flood coverage (often separate)

- Earthquake coverage

- Hurricane or windstorm riders

A good Takaful provider will help you match coverage to your local risks rather than just selling a generic package.

How to Evaluate Whether a Takaful Plan Is Truly Halal

Beyond marketing language, here are concrete steps you can take:

Step 1: Look for a Shariah Supervisory Board

A credible Takaful operator should have an independent Shariah Supervisory Board (SSB) made up of qualified Islamic scholars in finance.

Check for:

- Names and credentials of board members on the website.

- A Shariah compliance certificate or public statement.

- Regular Shariah audits or reviews.

If the provider cannot clearly identify who oversees Shariah compliance, proceed with caution.

Step 2: Understand the Operating Model

Common Takaful models include:

- Wakala model: The operator charges a transparent management fee for running the pool.

- Mudarabah model: The operator shares in the investment profits according to a pre-agreed ratio.

- Hybrid models: A combination of both.

Ask:

- “Which Takaful model do you use for your home protection plan?”

- “How is the operator compensated, and how are participants’ interests protected?”

Step 3: Ask About Surplus Distribution

If there is money left in the pool after claims and expenses:

- Is it shared with participants?

- Is it retained to strengthen the pool?

- Does any of it go only to shareholders?

A transparent surplus policy is a sign of a well-structured Takaful program.

Step 4: Review the Claims Process

In real life, what matters most is how you’re treated when something goes wrong.

Look for:

- A clear, step-by-step claims process explained in simple language.

- Average claims processing times.

- Options for filing claims online, by phone, or through an agent.

You can ask:

- “Can you walk me through what happens if my kitchen catches fire?”

- “How long does it usually take to receive a payout after a claim is approved?”

Takaful America highlights mutual support and ethical practices in its approach, which includes transparent explanations of how protection plans work and how members are supported at claim time.

Practical Tips for Muslim Homeowners Comparing Plans

When you’re comparing halal home protection options, use this checklist:

1. Clarify Your Own Needs First

Before you get quotes, note down:

- The replacement cost of your home (not just the market price).

- The value of your personal belongings.

- Any special risks in your area (floods, earthquakes, hurricanes).

- Any home-based business activities that might need separate coverage.

2. Compare Coverage, Not Just Contribution Amounts

A lower monthly contribution is not always better if:

- Coverage limits are too low.

- Important risks are excluded.

- Deductibles are so high that you’d struggle to pay them.

Look at:

- Dwelling and contents limits

- Deductible amount

- Included and excluded perils

3. Check Financial Strength and Stability

Even a halal structure is not helpful if the provider cannot pay claims.

Consider:

- How long they’ve been operating.

- Whether they partner with established reinsurers.

- Any publicly available financial information or community reputation.

4. Read Real Experiences

Look for:

- Reviews from other Muslim homeowners.

- Community feedback at your local masjid or Islamic center.

- Testimonials or case studies.

5. Ask Direct, Open Questions

Don’t hesitate to ask the provider detailed questions about:

- Shariah governance

- Investment policy

- Claims handling

- Customer support

Their willingness to explain is itself a sign of transparency and integrity.

How a Takaful Home Plan Supports Your Long-Term Financial Goals

Choosing a halal home protection plan isn’t just about avoiding the haram; it’s also about building a healthier financial life over time.

A strong Takaful plan can:

- Protect your equity: If disaster strikes, you’re not forced to liquidate savings or sell assets at a loss.

- Preserve family stability: Your family can stay housed or quickly find alternative accommodation after a covered event.

- Align with your zakat and sadaqah mindset: Contributing to a mutual pool that helps others in hardship strengthens your sense of community responsibility.

- Reinforce your values: Knowing your protection is interest-free and ethically invested gives spiritual peace of mind.

By choosing a provider like Takaful America, you’re not only protecting your home—you’re also supporting the growth of halal financial infrastructure for Muslims in the U.S.

Bringing It All Together

To recap, a strong halal home Takaful plan should:

- Be built on mutual cooperation, not a sale of risk.

- Avoid riba, excessive uncertainty, and gambling-like structures.

- Invest only in Shariah-compliant, ethical assets.

- Provide robust coverage for your dwelling, belongings, liability, and extra living expenses.

- Be overseen by a qualified Shariah Supervisory Board.

- Offer a clear, fair, and transparent claims process.

When you see these elements in place, you can feel confident that your home protection is both financially sound and spiritually responsible.

Next Steps for Muslim Homeowners

If you’re ready to move toward halal home protection, here’s a simple path you can follow this week:

-

Review your current situation

- Do you have conventional homeowners insurance? Note your coverage limits, exclusions, and renewal date.

- If you’re uninsured, list your home’s estimated replacement cost and key risks.

-

Educate yourself on Takaful basics

- Re-read the key principles above.

- Write down any questions you want to ask a provider.

-

Reach out to a Takaful provider

- Visit Takaful America to learn more about Shariah-compliant protection options tailored for Muslims in the U.S.

- Request information or a consultation to discuss your specific home and family needs.

-

Compare and decide

- Look at coverage, Shariah governance, and customer service—not just price.

- Involve your spouse or family in the decision so everyone understands how the protection works.

-

Make your intention (niyyah)

- Approach this as both a financial decision and an act of responsibility toward your family and community.

Summary

Halal home protection through Takaful allows Muslim homeowners in the U.S. to safeguard their most important asset while honoring Islamic principles. By choosing a plan that avoids riba, minimizes uncertainty, and invests ethically, you protect both your house and your conscience.

Look for:

- A genuine Takaful structure based on mutual cooperation and tabarru’.

- Strong Shariah oversight and transparent investment policies.

- Comprehensive coverage for your building, belongings, liability, and living expenses.

- A clear, fair claims process and a provider that answers your questions openly.

Taking the time to select a truly halal plan is an investment in your family’s security and your long-term financial integrity.

Start Protecting Your Home in a Halal Way

Your home is more than bricks and drywall—it’s the heart of your family life. Protecting it in a way that aligns with your faith is both possible and within reach.

Visit Takaful America to explore Shariah-compliant home protection options, ask your questions, and take the first step toward a Takaful plan that reflects your values.

Make the intention, seek knowledge, and move forward with confidence—your home, your family, and your faith are worth it.